Since discovering a sizable oil discovery in offshore Guyana, Exxon Mobil, along with several exploration and production partners, actively explored the subsea field and is now producing thousands of barrels of oil per day from several FPSO platforms. Font: https://oilmanmagazine.com/auv-technology-pushing-offshore-guyana-ep-discovery-forward/

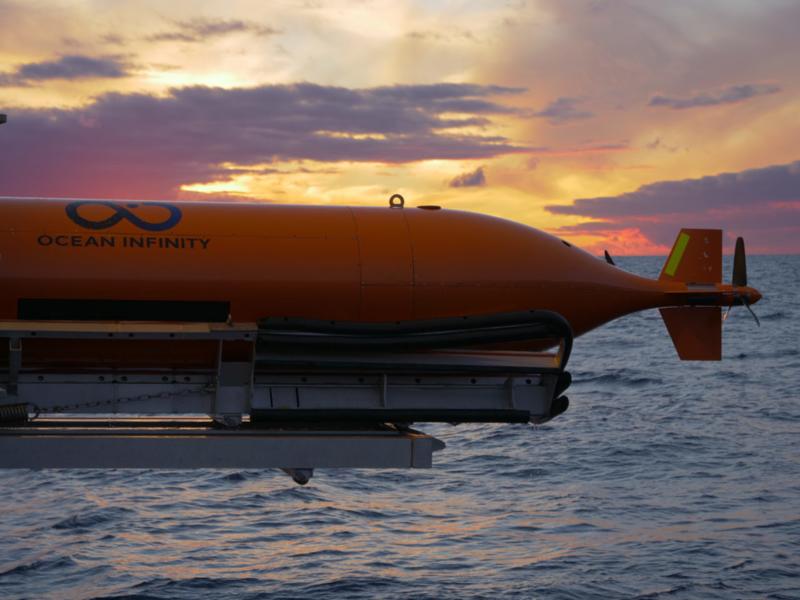

Exxon Mobil contracted with Ocean Infinity to conduct high-resolution geophysical and geotechnical data capturing using an autonomous underwater vehicle (AUV) over 3,100 square miles and in water depths of up to 7,000 feet. Using AUVs allowed the company to gather data quickly without significant environmental impacts, unlike conventional survey methods.

“The successful completion of this project for ExxonMobil in Guyana is further evidence of our ability to sustainably deliver the highest quality results to our clients using our cutting-edge robots. We are constantly striving to push technological boundaries so that we can rapidly deliver high-quality results and the upcoming deployment of our Armada fleet in January 2021 is further testament to this,” said Josh Broussard, CTO, Ocean Infinity.

Exxon Mobil initiated oil and gas exploration off the Guyana coast in 2008. Liza Phase 1 was the first producing platform to come online in 2015 comprising 295 feet of oil-bearing sandstone reservoirs. The company has discovered 16 oil and gas fields in the Stabroek block since Liza and is expected to produce more than eight billion barrels of oil. In the May/June issue of OILMAN, our publisher, Emmanuel Sullivan, reported on the Exxon Mobil discovery in offshore Guyana, read more here.